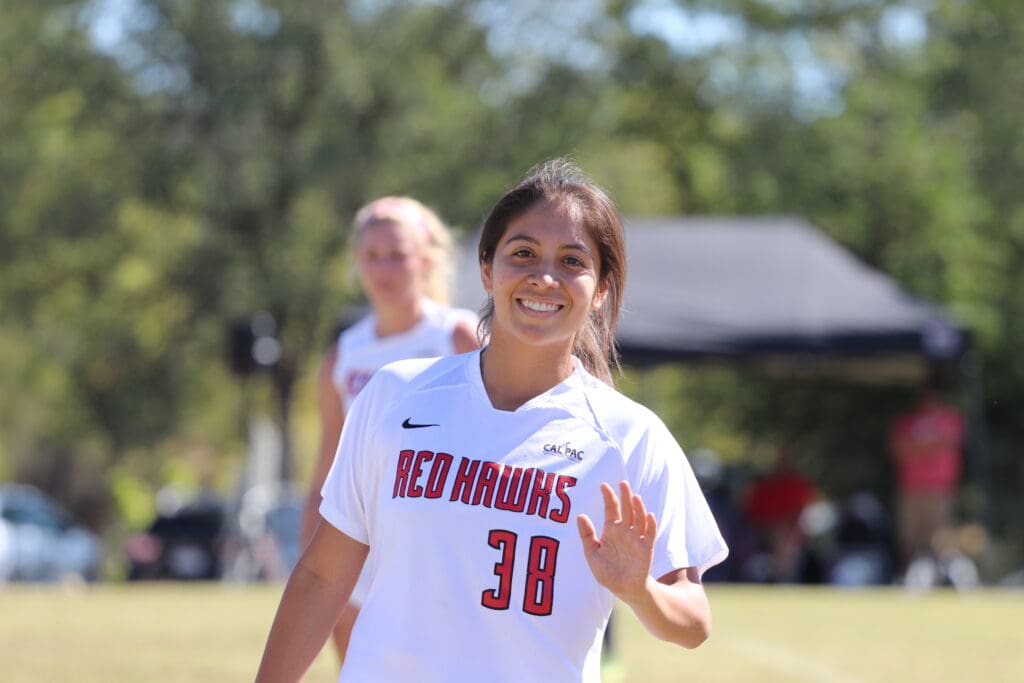

Education Options for All Stages of Life

Making a Difference in the World

We are dedicated to nurturing a community of faithful champions—individuals who understand that their education is a calling. Our commitment goes beyond academic excellence; it’s about cultivating leaders who, inspired by their faith, are ready to address the challenges of the world with compassion and integrity.

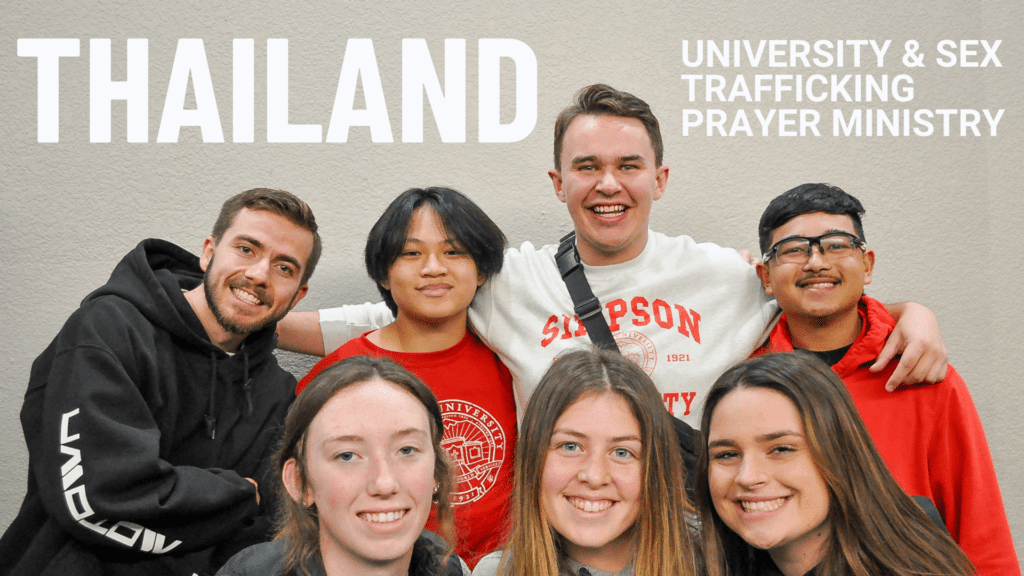

ATHLETICS

Welcome to the home of the Red Hawks, where the sky is the limit and the spirit of competition takes flight. With an impressive 80% of our student body being NAIA athletes, Simpson University is home to talent and dedication.

New Programs

We are thrilled to unveil a range of exciting additions to our curriculum, introducing new bachelor programs that cater to diverse interests and career aspirations. Our offerings now include a Master of Business Administration with a Leadership emphasis, Engineering, Social Welfare, Sports Management, Digital Media, and Community Counseling. These carefully crafted programs are designed to provide students with a comprehensive education, opening doors to a myriad of career opportunities and preparing them for success in dynamic and ever-evolving fields.

$25K

Average Cost After Aid Traditional Undergrad

98%

Students in a Career or Grad School within 6 Months

22

Athletic Programs

2hrs

Mountains, Beach, Wilderness, Skiing

fly with us

INTERNSHIP AND Job Placement Guarantee

Simpson University strives to provide every student with an affordable and transferable education. It is our goal to help you become highly employable. That is why we offer the promise that if you cannot get a job following graduation, we will provide you with free additional credits towards a second major.

Simpson Rising – ON the front EDGE of the great commission

News and Features

You can see god from anywhere if your mind is set to love and obey him.

A.W. TOZER